A new Republican-led Senate proposal is drawing sharp criticism from borrowers and policy experts alike, with many warning it could jeopardize student loan forgiveness for millions of Americans. The bill, introduced by Senate Republicans on June 10, would drastically change repayment plans, extending timelines and reducing the availability of loan relief.

GOP Proposal Could Delay Student Loan Forgiveness by a Decade

Currently, borrowers enrolled in income-driven repayment (IDR) plans can qualify for student loan forgiveness after 20 to 25 years. The new GOP-backed Repayment Assistance Plan (RAP), however, would require borrowers to remain in repayment for 30 years before any debt is forgiven.

Mark Kantrowitz, a widely cited education expert, stated that many low-income borrowers would likely be stuck making monthly payments for three decades under RAP—making it significantly harder to achieve student loan forgiveness within a reasonable time.

Experts Warn of Surge in Defaults

Sameer Gadkaree, president of The Institute for College Access & Success, said the GOP’s plan would “unleash an avalanche of student loan defaults.” He added that by making loans harder to repay and limiting forgiveness, the plan would cause “widespread harm to American families.”

Mike Pierce, executive director of the Student Borrower Protection Center, echoed the warning. In a letter to the Senate Committee on Health, Education, Labor and Pensions, Pierce wrote that the plan would “saddle millions of borrowers across the country with more student loan debt.”

According to his group’s analysis, a typical borrower could pay $2,929 more per year under the new plan compared to President Biden’s now-blocked SAVE program, which aimed to increase access to student loan forgiveness.

Borrowers Will Have Fewer Choices

First Option for student loan repayment

Under the GOP’s proposed changes, borrowers taking federal student loans after July 1, 2026, will have only two repayment options. The standard plan would stretch fixed payments out as long as 25 years, depending on the loan amount. Borrowers who owe more than $100,000 would be locked into a 25-year term.

Second Option for student loan repayment

The second option, RAP, bases monthly payments on income—ranging from 1% to 10% of a borrower’s salary. While it includes a $50-per-dependent payment reduction, the plan lacks the more generous forgiveness provisions found in earlier IDR options.

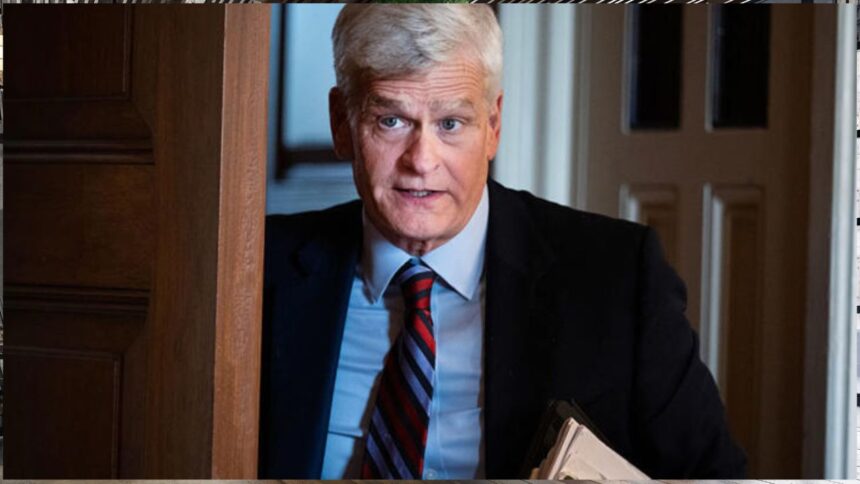

GOP: Plan Protects Taxpayers

Senator Bill Cassidy, R-La., chair of the Senate HELP Committee, defended the plan. He argued that the proposal would prevent taxpayers who never attended college from having to pay off others’ degrees. “Biden and Democrats unfairly attempted to shift student debt onto taxpayers that chose not to go to college,” Cassidy said, claiming the bill would save over $300 billion.

More Borrowers Could Fall into Default

With over 42 million Americans holding federal student loans totaling more than $1.6 trillion, the stakes are high. As of April 2025, more than 5 million borrowers were in default. That number could double if student loan forgiveness becomes harder to obtain under the new plan.

Critics say the bill arrives at the worst time—when the economy remains fragile and the cost of living continues to rise. Many worry that longer repayment terms and delayed forgiveness would force borrowers to postpone life milestones like buying a home or saving for retirement.

Final Takeaway

The Senate GOP’s proposal could reshape the student loan landscape for decades. While framed as a way to protect taxpayers, experts argue the changes would make student loan forgiveness less attainable and increase the risk of long-term debt burdens for millions.